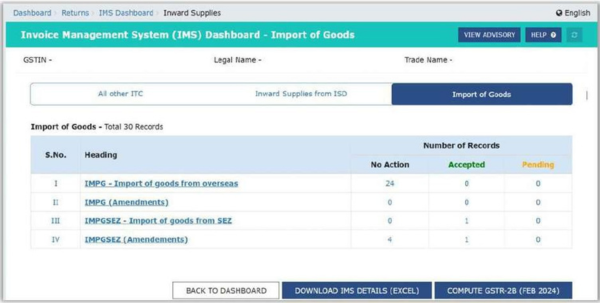

The Invoice Management System (IMS) has introduced a new section called “Import of Goods” from the October 2025 tax period, aimed at enhancing convenience for taxpayers importing goods. This section allows recipient taxpayers to view and take actions on individual Bills of Entry filed for imports, including those from Special Economic Zone.

Key Features:

- Bills of Entry related to imports will be visible under IMS for taxpayers, who can then accept or keep pending these entries.

- If no action is taken on a BoE, it will be deemed accepted automatically.

- The GST portal generates a draft GSTR-2B for the recipient on the 14th of the subsequent month, reflecting the accepted BoE entries.

- Actions on BoE entries can be changed even after GSTR-2B is generated but before filing the corresponding GSTR-3B.

Types of BoE Entries in IMS:

- IMPG: Imports from overseas

- IMPG Amendments: Adjustments to original imports from overseas

- IMPGSEZ: Imports from SEZ

- IMPGSEZA: Amendments to imports from SEZ

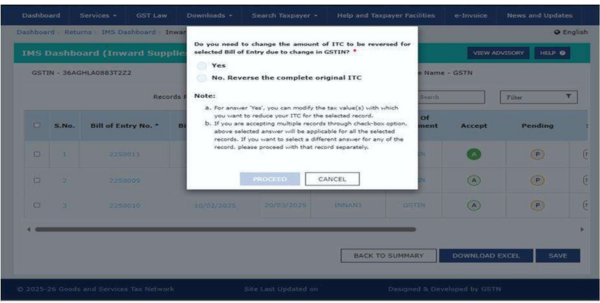

Important Points on GSTIN Amendments in BoE:

- If the GSTIN on a BoE is amended after ITC has been availed by the previous GSTIN, the previous GSTIN must reverse the ITC.

- The previous GSTIN has an option to declare the amount of ITC to be reversed, considering any prior reversals.

- The amended GSTIN will then be eligible to claim ITC for the revised BoE.

Example:

Suppose a taxpayer with GSTIN G1 imported goods and claimed ITC on Bill of Entry no. 10123. Later, the GSTIN gets amended to G2. In this case:

- G1 must reverse the previously claimed ITC on that BoE.

- The GST system allows G1 to declare the amount of ITC to reverse if partially reversed earlier.

- G2 can then claim the appropriate ITC on the amended BoE.

Actions Allowed on BoE:

- Accept: The BoE record is accepted and will reflect in the ITC available in GSTR-2B and auto-populate in GSTR-3B.

- Pending: The BoE can be kept on hold and will not appear in GSTR-2B or 3B until accepted.

- Note: Reject action is not allowed for BoEs.

Key Points regarding treatment of BoE in IMS:

1. “Reject” action is NOT allowed for Bills of Entry

2. “Pending” action is NOT allowed in the following cases:

- Downward value amendment of BoE where the action on the original BoE was accepted & corresponding 3B has been filed.

- For reversal of ITC in case of GSTIN amendment of BoE for the previous GSTIN.

3. In case of multiple value amendments of a BoE, the latest record shall be shown in the IMS.

4. In case of the following scenarios, actions taken on the records shall not be saved and a partial save message shall be displayed:

- Attempting to save pending action on downward amended BoE (where original BoE was accepted and respective ITC availed in GSTR-3B)

- Attempting to save pending action on GSTIN amendment record requiring reduction of ITC.

- Attempting to save the action on amended record where original record is kept pending. In such case, the taxpayer first needs to take action on pending original record.

5. In certain scenarios the BoE will be removed automatically from the IMS dashboard. An information message will be displayed upon removal of records from IMS. Following are the circumstances where such removal occurs:

- When GSTIN amendment of BoE happens before filing of GSTR-3B by previous GSTIN (G1) or the original BoE was kept pending, then the original BoE shall be removed from IMS dashboard of the previous GSTIN (G1).

- When there are multiple value amendments for a BoE, then the latest amendment record replaces the earlier amendment record on IMS

dashboard. Here, the earlier amendment record shall be removed from IMS.

6. In case the amended BoE is deemed accepted, the corresponding pending BoE will be removed from IMS dashboard on filing of GSTR-3B.

7. Optional functionality of providing Remarks will be applicable when taxpayer wishes to keep a record pending.

8. At the time of GSTR 2B generation, a record will be considered as ‘Deemed Accepted’ if no action is taken on that record in IMS.

9. It is mandatory to recompute GSTR 2B from IMS dashboard in case of any change in action already taken on concerned records or any action is taken after 14th of the month i.e. date of generation of Draft GSTR-2B.

10. All the accepted/deemed accepted BoE records will move out of IMS dashboard after filing of respective GSTR-3B.

11. Pending records will remain on IMS dashboard and these records can be accepted in future months.

12. Certain changes are made to GSTR-2B:

- Following additional columns shall be displayed under IMPGA & IMPGSEZA:i. Type of Amendmentii. Whether ITC needs to be reduced for the selected Bill of Entry? (Yes/No)iii. Amount declared by taxpayer for ITC reduction – IGST

iv. Amount declared by taxpayer for ITC reduction – Cess

- Removal of column for “Amended (Yes/No)”.

- The GSTR-2B excel shall now have 4 sheets for import of goods – IMPG, IMPGA, IMPGSEZ & IMPGSEZA.

13. Following changes are made to GSTR-2A pursuant to processing of BoE GSTIN amendments:

- Introduction of new column for “Type of Amendment” in “Amendment History”. Type of amendment shall indicate “Value” (in case the value of BoE amended) or “GSTIN”(in case the GSTIN of BoE changed) or “NA” (for original BoE).

- The record for previous GSTIN will continue to be shown in their GSTR-2A of such month. Details of GSTIN amended record shall be available under Amendment History.

- The record for the amended GSTIN will be shown in their GSTR-2A of the month when such GSTIN amended record is processed. Details of original record shall be available under Amendment History.

This advisory helps GST taxpayers accurately manage ITC on imported goods via the IMS, enhancing compliance and correct ITC claiming.